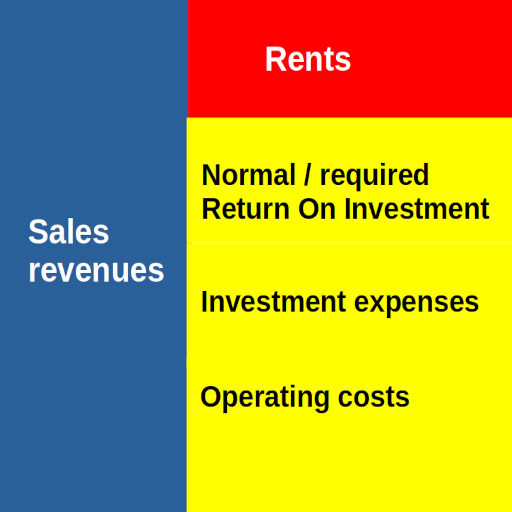

Rents can be measured as a surplus cash flow, see table1 and figure1 below.

| Revenues (sales) | |

| – | Cost of Goods Sold (COGS) |

| – | Selling, General & Administrative costs (SG&A) |

| – | Research and Development costs (R&D) |

| – | Investments (Capex expenses) |

| + | Depreciation (to adjust for the depreciation costs in COGS, because investments are fully expensed as cash flow) |

| – | normal Return On Investment (the return in competitive markets, which is the required return for long-term continuity of the firm) |

| = | surplus cash flow = rents |

For this calculation I use data in the operational section of the Statement of cash flows in Annual reports. The normal return on investment is discussed in the blog A normal return .

Rents in one year may be an incident, e.g. temporary scarcity due to a bad harvest or a war. It is the persistent rents which are relevant as the result of possession of scarce or exclusive assets. A proxy for persistent rents is the minimum of rents in five years. For example: if rents in the last five years were 26, 28, 22, 30, 32 % of revenues, then the minumum % in the last five years was 22%. That is: proxy for persistent rents = 22% of revenues.

Figure1 Rents as surplus cash flow

The method above is explained in detail in my paper in the Cambridge Journal of Economics, volume 47, issue 4, July 2023, https://doi.org/10.1093/cje/bead025